[url=wwwdotservimg.com/view/20531943/1] [/url]

[/url]

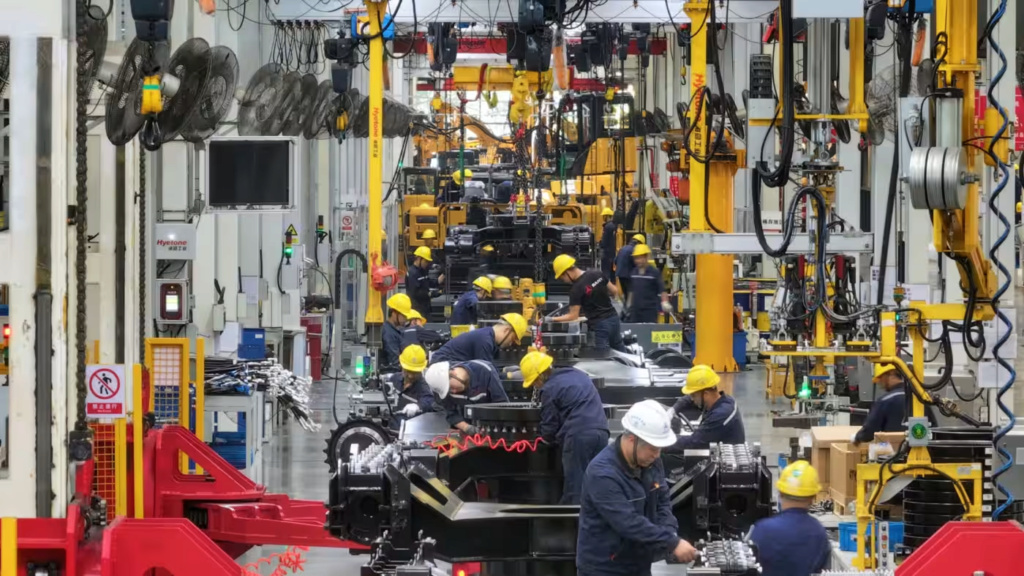

summary: According to a recent analysis, the net incomes of major listed companies in various economies increased by 3% compared to the same period last year. However, manufacturing profits declined for the fourth consecutive quarter, with nine out of 16 major industries reporting a decrease in profits. The chemical industry was hit the hardest with a 43% decrease, while the electronics sector suffered a 12% decline. The slowdown in China had a significant impact on manufacturers, especially those with a higher reliance on Chinese sales. Non-Chinese manufacturers with a 30% or more ratio of Chinese sales to total sales experienced a 30% decrease in net income. Industries such as semiconductor manufacturing and chemical production were heavily affected by the decline in demand, resulting in profit declines of more than 20%. Similarly, capital investment in China slowed, leading to a decline in sales of factory automation equipment. This had a negative impact on companies like Fanuc, which experienced a 20% decline in profit. Concerns also arise regarding the potential impact of prolonged U.S. monetary tightening on the global economy. Higher interest rates could lead to a decline in loan demand and an increase in defaults, posing challenges for strong financial performance.

Why is the news interesting/important: There are worries that a protracted monetary tightening in the United States may cause the largest economy in the world to slow down in addition to the already weakening Chinese economy. An obstacle to solid financial success would be higher interest rates, which could cause defaults and a drop in the demand for loans. The price of writing off bad loans are mounting for certain banking organizations. The CEO of Wells Fargo, Charles Scharf, stated, "We have continued to take some credit tightening actions." The previously strong US economy is beginning to weaken. October had the lowest level of the nonmanufacturing business confidence index in five months, according to the Institute for Supply Management, a U.S.-based organization. Numerous businesses could be impacted if the US economy collapses.

Ref : wwwdotasia.nikkei.com/Business/Companies/China-s-slow-economy-takes-9-off-global-manufacturers-profits

[/url]

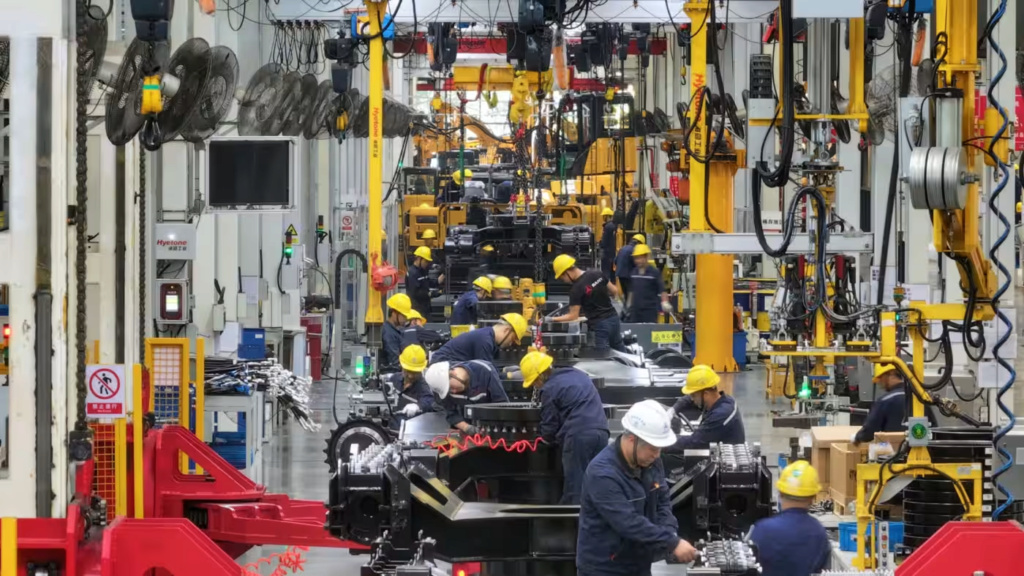

[/url]summary: According to a recent analysis, the net incomes of major listed companies in various economies increased by 3% compared to the same period last year. However, manufacturing profits declined for the fourth consecutive quarter, with nine out of 16 major industries reporting a decrease in profits. The chemical industry was hit the hardest with a 43% decrease, while the electronics sector suffered a 12% decline. The slowdown in China had a significant impact on manufacturers, especially those with a higher reliance on Chinese sales. Non-Chinese manufacturers with a 30% or more ratio of Chinese sales to total sales experienced a 30% decrease in net income. Industries such as semiconductor manufacturing and chemical production were heavily affected by the decline in demand, resulting in profit declines of more than 20%. Similarly, capital investment in China slowed, leading to a decline in sales of factory automation equipment. This had a negative impact on companies like Fanuc, which experienced a 20% decline in profit. Concerns also arise regarding the potential impact of prolonged U.S. monetary tightening on the global economy. Higher interest rates could lead to a decline in loan demand and an increase in defaults, posing challenges for strong financial performance.

Why is the news interesting/important: There are worries that a protracted monetary tightening in the United States may cause the largest economy in the world to slow down in addition to the already weakening Chinese economy. An obstacle to solid financial success would be higher interest rates, which could cause defaults and a drop in the demand for loans. The price of writing off bad loans are mounting for certain banking organizations. The CEO of Wells Fargo, Charles Scharf, stated, "We have continued to take some credit tightening actions." The previously strong US economy is beginning to weaken. October had the lowest level of the nonmanufacturing business confidence index in five months, according to the Institute for Supply Management, a U.S.-based organization. Numerous businesses could be impacted if the US economy collapses.

Ref : wwwdotasia.nikkei.com/Business/Companies/China-s-slow-economy-takes-9-off-global-manufacturers-profits

Home

Home